Saving Life Insurance

To promote savings habits of SATHAPANA clients and provide financial protection during vulnerable emergencies, SATHAPANA offers Saving Life Insurance (Triple Cover Plan). This endowment-based solution is thoughtfully crafted for SME clients and their associates, combining two core components: long-term savings and comprehensive financial protection.

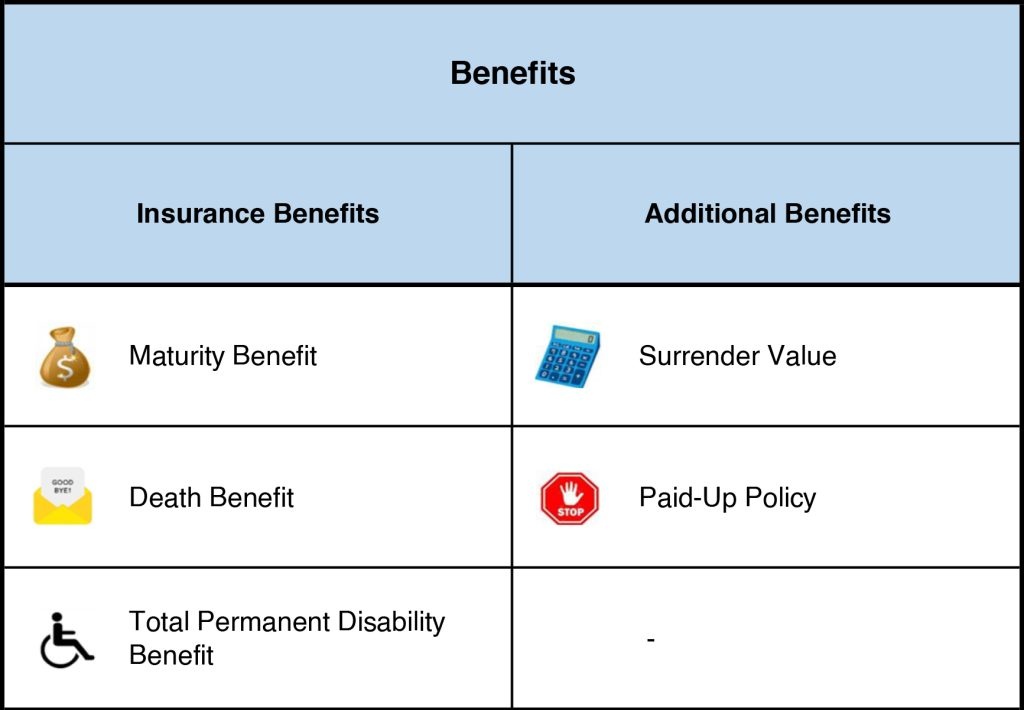

By choosing Saving Life, policyholders can strengthen their financial well-being while ensuring peace of mind for their families. The product is designed to help clients face life’s uncertainties with confidence, providing dependable support during personal hardships, including death or total and permanent disability.

Saving Life Insurance

Why should you purchase a saving life insurance policy and start saving money?

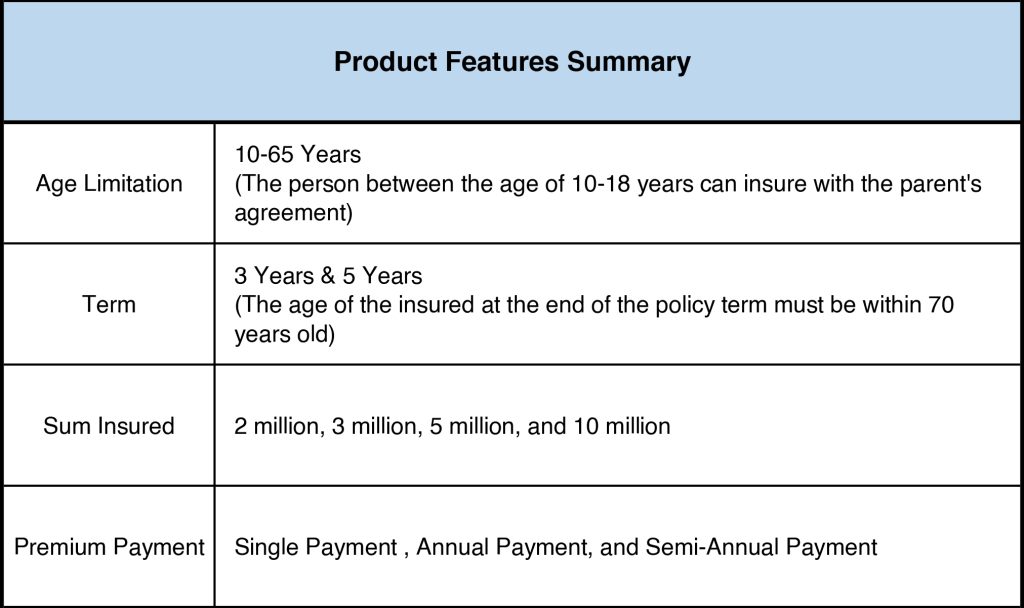

- The sum insured and policy term for saving life insurance are affordable and accessible for everyone.

- Purchasing a saving life insurance policy helps develop a habit of saving money and strengthens financial discipline and commitment.

- In the unfortunate event of accidental death during the policy term, three times of the sum insured will be paid as compensation.

- If no incidents occur during the policy term, 100% of the sum insured will be returned, allowing you to accumulate savings.

Saving Life Insurance Product Features and Benefits